Overview

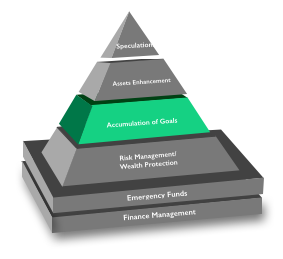

Now that you’ve Set your Base at Stage 1, provisioned your Protection at Stage 2, it’s time to set financial goals and start building.

Something great about having the first 2 Stages completed before you start with Stage 3 is that you are more secured and equipped now, I.e. Your Finances are better managed.

However, you should constantly revisit the 2 stages as your progressed. Here are some stages where you should revisit them:

As your Asset & Liabilities Increases.

- Protect your assets as you do not wish to liquidate them in an untimely fashion and loses money.

- Protect your dependant from inheriting your liabilities.

As you progressed with your life “promotion”.

When you start a family and is responsible for your dependant. Especially when you have children.

So with your available Emergency Funds which is self sustaining by itself, standing by for any unexpected expenses and your protection plan for unforeseen large bills, you can now initiate your wealth building with peace of mind.

However, as we want to start building our first pot of gold, things might be too early. This is because, before we can start accumulating for that, there are shorter term goals we need to achieve. That is saving for marriage, first flat, new born, etc… How soon to achieve these really depends on what percentage of your income you are willing to sacrifice, the more you put aside for savings, the faster you achieve them.

Whatever it is that you have in mind, set a Financial Goal at this stage. After setting your Financial Goals these are some key factors for consideration before you shop for the right Financial Tools to help you achieve them.

- What is your investment profile? Conservative, Balance or Aggressive?

- At this stage for short term goals, your savings or investment horizon is limited to short term.

- Do you want to do a lump sum investment or in regular intervals?

While the following are “once in a life time experience” events, avoid getting unnecessary loans as it is definitely unwise.

Saving for Marriage

Let’s take a look at a typical cost for marriage. From couples i have spoken with, the amount should range from $50,000 to $80,000 depending on how much “face value” you want.

The breakdown on the cost is roughly as follows:

| Items | Price Range |

|---|---|

| Wedding Solemnization: | $3,000-$5,000 (location rental and reception) |

| Wedding Banquet: | $36,000-$54,000 (for 30 tables that cost $1,200-$1,800 each – usually a table is for 10 people) |

| Bridal Package: | $700-$2,000 |

| Videography/photography: | $2,000-$4,000 |

| Total Estimates: | $40,000 to $65,000 |

This list is definitely not exhaustive. However, there will be many other additional costs that pop up along the way.

So now let’s take an assumed cost of $50,000 for the whole event and assuming the cost is split among the couple, each should need $25,000 to execute this event.

So now, you have a financial goal of $25,000.

Assumption:

| Description | Value |

|---|---|

| Monthly Income: | $2,000 |

| Save 20% of monthly income: | $400 |

| Total amount needed: (current value) | $25,000 |

| Total amount needed in 6 years: (future value with average 2.4% inflation rate) | $28,823 |

Let us look at various options for you to understand how Interest Rates and Compounding Interest have in effect to money.

| Description | 1.1 – Typical Saving Account | 1.2 – Typical Savings account with Lump Sum | 2.1 – Investment (Moderate) | 2.2 – Investment with Lump Sum (Moderate) |

|---|---|---|---|---|

| Leveraging with a Lump Sum (Emergency Fund): | NA | $12,000 | NA | $12,000 |

| Risk Level: | No Risk | No Risk | Moderate | Moderate |

| Interest Rate per annum: | 0.05% | 0.05% | 3.6% | 3.6% |

| Total period needed to reach target amount: | 72 mths (6 yrs) | 76 mths (7 yrs 2 mths) | 65 mths (5 yrs 3 mths) | 60 months (5 yrs) |

| Total Amount Saved at end of period: | $28,843 | $40,879 ($40,879 – $12,000 = $28,879) | $28,746 | $40,694 ($40,694 – $12,000 = $28,694) |

| Total compounded Interest earned over period: | $43.84 | $79.90 | $4,213 | $7,463.49 |

With the above, when will you be able to save that amount?

- Total period needed: 86 months (7 years & 2 months)

- Total amount received: $28,948

- Total Interest over 86 months: $52.42

Vomit blood right…

Now, are there better options to speed things up without contributing more than 20% of your savings?

Yes, definitely! Assuming you have your Emergency Fund available, you should start using that Fund to start growing it. Assuming your Emergency Fund is $12K (6 months of your income). With the similar assumption above, let’s use the $12K as your based amount as an additional amount.

- Additional based amount with Emergency Fund: $12,000

- Monthly Income: $2,000

- Save 20% of monthly income: $336

- Investment Dividend per month: 0.6%

- Risk Level: Balanced Investment Risk

- Total amount needed (current value): $25,000

- Total amount needed (future value with average 2.4% inflation): $28,823

With the above when will you be able to save that amount?

- Total period needed: 59 months (4 years & 11 months)

- Total amount received: $40,923

- Total Interest over 59 months: $9,099

So with the $40,923, recovering your Emergency Fund of $12,000, you will have $28,923

However, if you don’t intent to leverage on your Emergency Fund of $12,000. It will take:

- Total period needed: 68 months (5 years & 8 months)

- Total amount received: $28,280

- Total Interest over 59 months: $5,431