Overview

Protection in layman term “Insurance” is the most ignored or even most hated attempt to purchase for most . While this is often ignored by many, many doesn’t really understand the value of this probably because there are a lot of mis-selling by agents before or it might be that it’s a purchase of an intangible product where you will only benefits from it when certain events happens or you experience certain medical or health conditions.

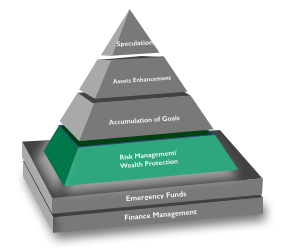

However, anyone who has unpleasant experience or has well informed Financial Literacy can totally understand that this is a risk management and is a basic part of Financial Planning. In another way, it’s just like why all vehicles in Singapore is required to have a car insurance. Similarly, every individual should be protected with it in a way or another in order to protect your wealth since we human being are actually more vulnerable as compared to machines.

Always remember that it’s always a doctor who will save your life in times of medical conditions, such protection only provides you with the financial support in times of needs arises and protects your current cash, assets and wealth or your existing investment port folio so that you need not liquidate them abruptly and disrupt your financial goals to achieve financial freedom.

Before you begin with this stage, it is highly recommended that you have completed Stage 1 – Setting your base and have your Emergency Fund set aside.

Can you skip this stage to Goal Accumulations?

Definitely you can skip this stage but you must be prepared for the following:

- Liquidate your assets or investments even at times of loses. (provided you have any to liquidate)

- Wipe out all your existing cash on hand which you have worked extremely hard to earn and has been thrifty in your lifestyle to save to handle the unforeseen and unpleasant situations. (provided you have cash savings)

- Resort to borrowing from friends or relatives, depending on others to provide you with financial support.

- Have your love ones to be the one going through emotional instability and at the same time worry about financial supports for you at times of Death, Disability or Critical Illness, note that this is a state where you might no longer work for an income and possibly a change of role into a dependant.

So if you are prepared for the above and is fine with taking any of the options when crisis strike, yes you can definitely skip this stage altogether.

Assuming that you are not ready to take any of the options and if you can understand the fact that we human being is a time bomb, we will definitely leave our loves one eventually but we just do not know when and how we will leave this world. Therefore, Protection is required to protect your Wealth, Assets and lessen your family’s financial burden when the unforeseen and unpleasant arises.

So it’s up to you to gauge if a diverting a small percentage of 5% to 10% of your income to an Insurer to provide such protection makes sense or not.

What should you be protected against?

Hospital & Surgical (H&S)

This is the most basic which I will highly recommend that you are protected earlier before this stage (at Finance Management) as the premium is relative cheap at younger age. This will covers all hospitalisation bill for standard inpatient and certain outpatient treatments if you have got a comprehensive Integrated Shield Plan with a “Cash Enhancer” to address your co-insurance and deductibles.

It will make sense to have this protection not only for yourself, but your spouse, children and even your parents. If you are definitely sure that you will be the one bearing the cost in times of hospitalisation of any of your love ones, I suggest you have these protection done up at the soonest so as to protect your cash and assets when crisis strikes. This will definitely lighten your stress since financial support is off loaded from the state of emotional aspect.

Trust me that your Medisave and Medishield is not sufficient when a critical illness were to hit hard on you or your love ones.

- Medisave: Basic Healthcare Sum is $63,000 (as of Jan 2021)

- MediShield Life: With cap on certain treatments, Annual Limit $150,000 and LifeTime unlimited (as of Mar 2021)

Comparing to an Integrated Shield Plan where you enhances your MediShield Plan: An “as charged” plan with more than 7 times the Annual Limit and Lifetime Limit is Unlimited, where you can utilise the premium with both your Medisave and Cash. depending on your age, assuming below 30 years old, annual premium from Medisave is less than $500 and “cash enhancer” is less than $2 a day.

You can find out more of Medisave Approved Integrated Shield Plan from here.

Now let us look at Protection’s 3 important coverages, that are Critical Illness, Total Permanent Disability and Death.

Critical Illnesses (CI)

Some might think that in the case of a critical illness, your H&S plan will be able to cover your medical bills. You might want to reconsider your thoughts as H&S will only cover your bill while warded, a period for your treatment after discharged as outpatient. CI coverage with lump sum payout is definitely be useful to cover you as a form of Income Replacement when you are not fully recovered to work. And are sure that an employer will still hire you if you are a cancer patient?

Since Cancer is key cause of death, where 28.4 % of death in 2019 (Principal Cause of Death), and has been the top killer in recent years. Let’s look at what else you might need financially:

- Income Replacement: when you are medically unwell to work for a few years to go through treatment, E.g. Radiotherapy or Chemotherapy.

- Payment for Long Terms medication: if needed to control your condition to survive.

- Recovery: Assuming you have completed your medical treatment, do you think you need to consume more supplements to nourish your body system to reinstate your body condition? That will require money too.

- Limitation to H&S Plans: Our H&S plan will only cover our standard treatment. If there is a one and only newly researched non standard treatment to save your life which require payment by cash will you take it? If you do, where do you get that money from.

So it depends on you how much coverage you think you will need to have coverage on Critical Illness or better still Early Stage Critical Illness. For an example, $50K a year for income replacement for 4 years will be $200,000, with an additional $100,000 in case there is long term medication/recovery/non-standard treatment. Worked out to be around $300,000.

Total and Permanent Disabilities (TPD)

This might be one of the worst situation, let’s take Stroke for an example and you are in a state of paralysis where you are unable to earn an income and requires care taking from your family members. So imagine when you can’t contribute to your family income, furthermore becoming an additional dependant to your family members whom at the same time is required to bring in income for the family. It will be devastating if your children are still young when such crisis happens, it will be a huge burden for your spouse and probably your children.

As such, this should also be considered as a protection to protect your cash and assets. Just imagine you have a coverage of $500,000 and had made a lump sum claim when this happens. If you could use this lump sum to earn an annual interest of 5%, you will have an annual income of $25,000 comfortably. Better still if you have a higher coverage, let’s say $1 million coverage on this, you can purchase a private property and collect rental as income. Without these, you might end up doing other wise which is to sell your own property to downsize it in order to carry on with life comfortably.

Similarly depending how much coverage you need for this condition, typically more than that of CI as for CI there is a chance to recover, but for disability since its Total Permanent Disability, its Life Time. Do note that most insurer only covers TPD till age 65 only.

Death

Death protection is often neglected by those who are single, which is fair. The reason for Death protection is to provide your family especially those with children an amount to pull through their tough times when you, possibly the sole bread winner of the family is gone.

However, this payout i meant to provide your family or dependant an among to pull through for a period until they are all settled for from your departure.

Conclusion

I hope you’ve understood and appreciate the idea behind protection till this point. On average, depending on how much protection you need, diverting 5% to 10% of your existing income to provide you with protection is recommended, if it exceeds 20%, you might be over spending on protection and might be classified as KIA SI. 🙂

You should review your coverage regularly when your responsibility increases, e.g. owning a new property, having a new born, and asset is growing to balance the risk to asset ratio.

To find out more on protection products, do contact us here.