Start from The Basic!

I suppose most of us locally in Singapore should at least have a savings account opened since we were young and typically it will be a POSB/DBS saving account where our parents will help us put some money into savings. And since then, we would have cultivated a habit of saving money, which is good. However, the question is, is that all for personal finance management and should we carry on for the rest of our life? Definitely not, especially when you know a typical saving account interest rate is only 0.025% per annum. We are losing money every year especially when the mean inflation rate is 2.4%, unfortunately it is on the rise, so we are losing more as Singapore economy develops rapidly.

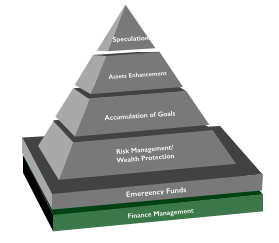

So As soon as we started working in the society, that is when our financial planning process should begins and it must begin at this stage. it’s time to understand and learn how to effectively manage your hard earned money.

If you have understood the 8 fundamentals of financial literacy, this is my recommendation to start and this works very well for me.

Budget Plan

You definitely need a budget plan to work out your expenses, that is to tell your money where to go instead of where did you money go at the end of every month. Always remember that money is your “tools”.

Work out what you need, the essentials only! Such as, mobile phone bills (subscribe to one that is sustainable and sufficient), allowance for parents, daily meals, transportation, entertainment, repayment of study loans if there is, for those with family, your expenses definitely will be higher, leverage on combine income ease out the expense, of course this have to be discuss with your spouse. There are definitely a lot of expenses tracking application in the market to aid in personal budgeting. However, i find it troublesome and time consuming to actively track and update. I will actually recommend the following in running orders:

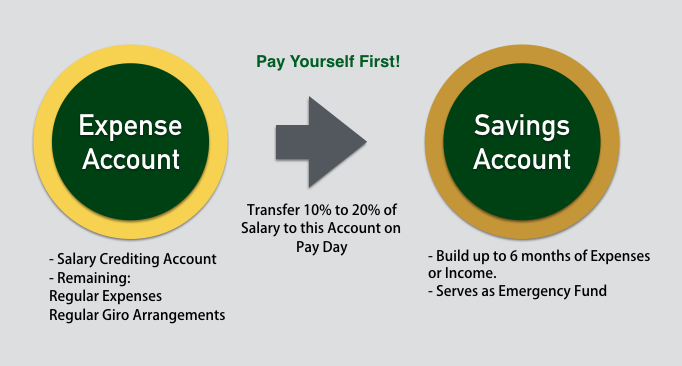

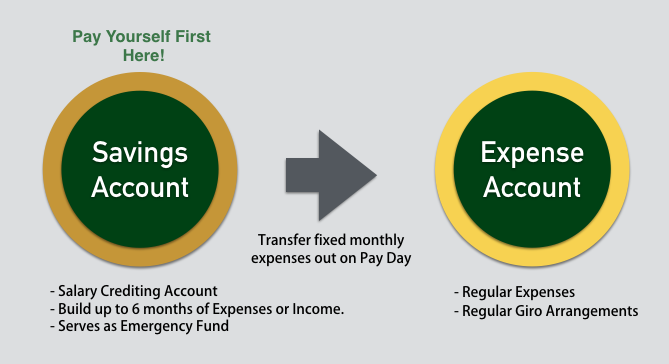

- Pay yourself first: It is recommended to transfer between 10% to 20% of your income to separate account. This will make sure you pay yourself first on your pay day. If you can allocate more than 20% and spend less that will be ideal! And I will highly recommend to you to break that specific account’s ATM card and make withdrawal inconvenient.

- *Pay your bills: cell phone bills, utilities bills, etc…

- The remaining: I will live with what i have for the month and above all I will suggest slotting $1 coins into a piggy banks as an additional savings / as petty cash. In no time you can use this petty cash for your “want” purchase without giving up on your “needs”.

*Tips: Try to pay through a rewarding Credit Card (if you are eligible) to earn royalty points which you prefer. For me I did with CitiPremiereMiles to earn Miles so that i can save on vacation flight tickets. However, DO NOT overlook the payment or attempt to get an insecure loan from it. If you have read about Good Debt vs Bad Debt, Credit Cards can be a useful Asset. Minimally you should go through Giro, because you are paying for your necessities, and most of them have late payment charges (Conservative Service Charges, Utility bills, etc...) and you won't want to overlook them. Download a copy of budget_template to start working on your budget. This template is catered for those who have just started out, however, you are free to adjust it to your lifestyle, just ensure you PAY YOURSELF FIRST.

If you are unsure what to budget for, I suggest you conduct a monthly expense tracking, just for a month to identify the list of items. A recommendation is to pay through NETS, keep receipts of what you spent on. This is the easiest way to consolidate your monthly expenses for a start and you can reorganise your budget from then onwards.

Below is a simple overview of how to manage your money for a start at this stages, I’ve got 2 options for you to adopt, there is no best and perfect way, but at least this is a proven approach that works. Feel free to adjust it to your preference, but without losing the fundamental, pay yourself first, and don’t spend more than you earn.

Basic Protections (Hospitalization)

Ok many of you might think that this is redundant at this stage. But I have to say there’s no way we can anticipate when will we need Health Care when the unpleasant arises, be it accident or illnesses. Mind you that our Medisave or Medishield Life DO NOT cover 100% of our medical expenses, therefore this is the most basic which you need to be covered for is to have an Integrated Shield Plan.

In a nut shell, assuming you are below age 30 and draws a monthly income of $2,000. All you need to pay for in terms of cash is less than $2 daily to have up to $700,000 coverage in hospitalisation bills and unlimited life time limit in a Private Hospital A Ward. It only takes less than 3% of your income to divert this risk to an Insurer.

There are 6 Insurers which you can choose from. Each having different coverage terms and conditions, therefore choose one that has features that suits your needs most and within your budget. Ministry of Health has provided a comparison table here for the basic Integrated Shield Plan between the 5 Insurers, therefore you might want to use this a reference to choose from.

Excess Savings (good to have)

Well, i will classify this as a bonus in paying yourself. If you can do some additional savings from your monthly expenses, you can definitely have some additional cash to possibly buy an item to pamper yourself or a vacation. Assuming if you have an excess of $2 daily, in a year, you will have $730 in addition to your regular savings which might bring you for a short trip to neighbouring countries.

For this excess savings, you can either do the old school piggy bank slotting on $1 coins only, or create another account to transfer the remaining of your expense account to it.

We shall look at how your Emergency Fund can be managed at the Protection Stage.

Tips: If you can maintain your lifestyle, with a consistence expense budget even when your income increases, you will be able to start accumulating you financial goals much earlier.