Definition: Inflation is a rate at which the general level of prices for goods and services is rising and subsequently, purchasing power is falling, in another words money value is decreasing. Simply put, our money gradually loses values at a rate denoted by a percentage.

So how is Inflation Rate measured?

It is measured by the Consumer Price Index (CPI), reflecting the annual percentage change in the cost to the average consumer of acquiring a basket of goods and services that may be fixed or changed at specified intervals, such as yearly.

Let’s have a quick overview of the key categories of CPI in Singapore context to have a better understanding of what is in the basket of goods and services affecting inflation.

[table “2” not found /]

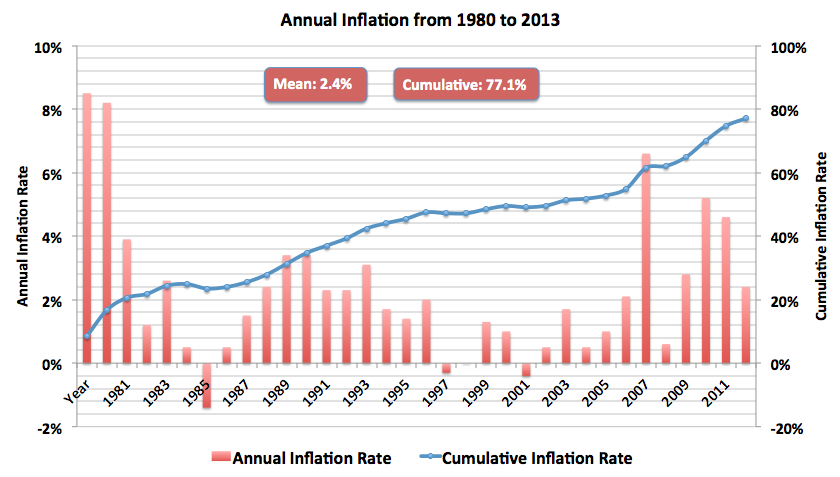

Now let’s take a look at the inflation rate over the past 33 years.

An Estimation

Rule 70 is not a commonly known rule, however it can basically an estimated measurement of how many years it takes for your money’s buying power to drop by 50%.

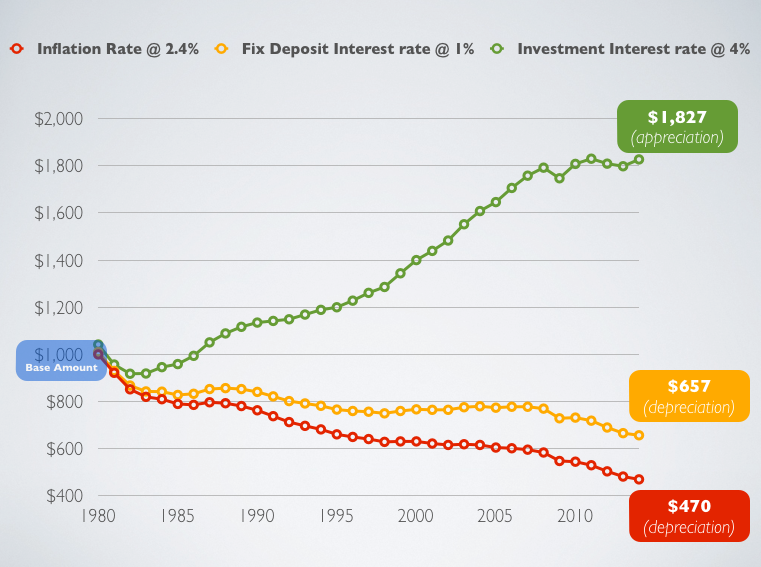

For an example, assuming Inflation rate of 2.4%.We use 70/2.4 = 30 years for your $1000 to become $500. The below chart should help to illustrate more.

So what does these means to you?

With an average (mean) inflation rate of 2.4% this means that your money can buy lesser gradually over each year.

Inflated Amount = Amount/(1 + inflation rate)^number years

Assuming:

- Amount = $1000

- Inflation Rate = 2.4%

- Number of Years = 1 and 33

- Inflated Amount = $1000/(1 + 0.024)^1 = $976.5625

In 1 Year:

$1000 with an annual inflation rate of 2.4% has a value of only $976.56 in 1 year.

In 33 Years:

Inflated Amount = $1000/(1 + 0.024)^33 = $457.1949565

As you can see, over a period of 33 years with the mean average of 2.4%, the value has inflated to $457.19.

Probably some might think that, well… if you’ve save that $1,000 in the bank it wouldn’t be that bad after all.

A typical saving account will only provides 0.025% interest rate, I shall be generous here, let’s see if a 1% interest rate helps.

So, from the chart above, If you were to put your $1,000 in a financial tool at 1980 that fetches 4% interest rate annually, it would have beaten inflation and holds an appreciated value of $1827 in 2013. Even putting into a fixed deposit with 1% interest rate would have made you lost around $350 with consideration of the inflation rate. So unless you do something with your money, you are definitely bound to lose $ if it’s kept in the saving accounts, that is guaranteed.