Definition of Debts: An amount owed to a person or organization for funds borrowed. Debt can be represented by a loan note, bond, mortgage or other form stating repayment terms and, if applicable, interest requirements. These different forms all imply intent to pay back an amount owed by a specific date, which is set forth in the repayment terms, usually includes an interest.

From our parents teaching, borrowing is a definite no, especially when most of us was brought up by our parents teaching us NEVER to borrow money from friends, as parents are afraid that we will spend future money and cultivates a bad habit of borrowing that might result in borrowing from Loan Shark. So subconsciously, most of us don’t have a habit of borrowing but still some does. However, unfortunately, in the environment we are in, we are already borrowing especially from Banks through Credit Cards, Housing Loans, Car Loans, etc…

Bank Loans is attractive to many as it allows one to have an amount which he/she doesn’t have in present time to purchase something through loans. They are able to make the purchase instantly and pay back the loan amount at a regular interval and often many are blinded by the small number of percentage as interest, which seems insignificant. So it solves the current problem but brings upon a long term commitment and possibly bigger problem.

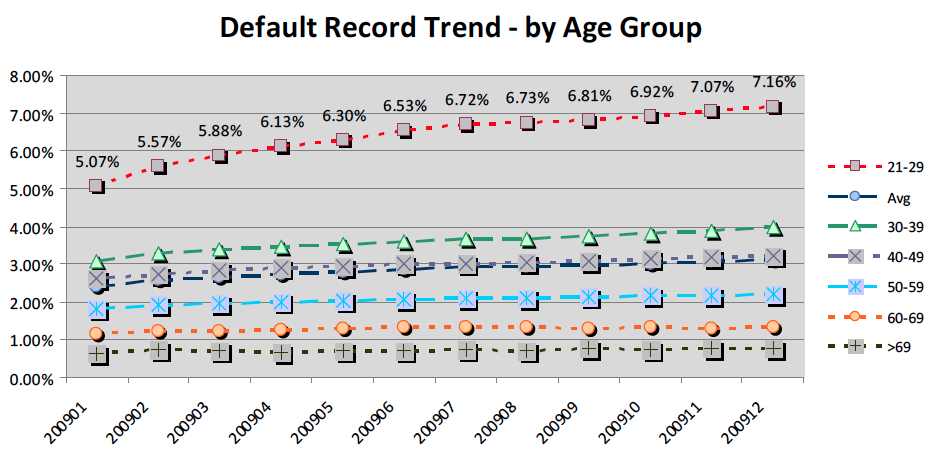

Loan / Debt with interest is a complex mathematics altogether. Not all of it is bad, but majority of Singaporean especially young Singaporean fail to realize until they fell into it. Based on a statistic tabulated by DP Credit Bureau, Singaporean of the age group 21 to 29 is showing an up trend of defaulting on their debts and is higher than any other age group. Isn’t this ironic?

source from DP Credit Burea

Therefore, if Debt is well understood and leverage correctly, it can turned into a good debt to help in one’s wealth enhancement instead of resulting in a default.

| GOOD DEBTS | BAD DEBTS |

|---|---|

| Study Loans Mortgage Loans Business Loans | Car Loans Credit Card Loans Renovation Loans *Installament Plan Loans (with interest) |

Good Debts

Now let’s understand what are Good Debts. When we borrow money to invest and your investment is income producing either in short or long term. (DO NOT attempt to borrow money to gamble, that is absolutely financially unsound!) Good debt is also where your loan amount considering the interest incurred for borrowing is invested and that investment increases in value more than what you need to pay back to the lender/Bank.

Study Loans

A typical example of good debt is money we borrow to go to school (Study Loan), when you graduate with your desired qualification, your career will progress to the next level, as well as your wages, and in a matter of time your investment will return. Not to forget your knowledge will increase as well and your market value is higher.

However, certain banks allow minimum repayment of loan from as low as $100 and repayment period for as long as 8 years. Avoid taking this 2 extreme options as the lesser you repay and longer you take, the more interest you are paying.

Let’s take a look at RHB Education Loan with 4.88% (as of June 2014)

Lets take the Deferred Repayment option

- Loan Amount: $50,000

- Loan Repayment Period: 10 years

- Length of studies 3 years

As such, the monthly repayment over 10 years is $610.37. Let’s do a simple maths here, $610.37 x 120 months = $73,244.40.

So for taking a longer repayment terms, you are paying $23,000 more for your $50,000 loan. That’s painful isn’t it.

Therefore, try to repay your study loan as soon as possible, even if there is a minimal prepayment penalty clear this as soon as possible within your means. Furthermore, with an increment of wages after acquiring your qualification you should be able to finance this repayment over a shorter period. Anyway, although the figures above might look WOW! Remember this is a still a good debt, just that don’t stretch your repayment period.

If you are a parent, and can already feel the pain of Study Loan repayment on your children when they grow old. You might want to consider saving / investing a fund for their future education. The most ironic thing will be a smart student unable to attend higher education due to financial problem.

Business Loans

Setting up a business that will generate a future stream of income in a long run provided you have already done your due diligent to work out your business and when your will break even and have your Return of Investment.

Mortgage Loan

Mortgage Loan for purchase of properties can be a good debt too if your invested property appreciate in value over the years and if the property appreciation rate goes higher than your loan interest rate, it will definitely be a win. However, proper analysis on the investment has to be carefully studied.

However, one should exercise his/her due diligent to assess if investment return is able to repay the interest rate from the borrowing.

Bad Debts

Bad Debt occurs when you borrow to purchase in an item (often a liability) and the value of the items declines over time. Many of us cannot avoid bad debt, so always be wise to minimise it whenever possible.

Instalment Plans

Some of us prefer to purchase expensive items through instalment plan. I realise most people who do this are more comfortable to slowly part away with your money rather than in one lump sum. This is emotional, and my advice is “don’t fall in love with your money”, be financially sounds and logical. Most of us might not be aware that most instalment plans actually charges an interest rate. For an example, an appliance which cost only $1,000 through instalment plan may cost $1200 over a 2 years instalment. That is a 20% more expensive.

Certain merchant allows 0% interest free instalment which you might be attracted to, which make sense but make sure your instalment period does’t span across your credit card renewal period as you might not get a complimentary renewal fee waiver if you are tied to any instalment plan.

And mind you, why are you getting into bad debts for purchasing liabilities? If you really need an item, pay in full with no debts and additional cost through interest.

Auto Loan

Auto Loan is definitely another bad debt when owning a car in Singapore is so expensive. If you don’t need a car, avoid buying one. Let’s take a look at a simple maths for a 3 years old used Honda Fit @ $70,000. with MAS ruling of maximum loan term of 5 years and loan amount of 50% or 60%.

Assuming the interest rate is 2.8%.

- Down Payment: $28,000 (40%)

- Loan Amount: $42,000 (60%)

- Monthly Instalment: $800

- Loan Term: 5 years / 60 months

- The actual amount you are paying is actually: ($800 * 60) + $28,000 = $76,000.

That is $6,000 more or 8.6% more on top of the extreme high cost of owning a car, even before we talk about COE and the following cost:

- Road tax: ~$600 annually ($50 monthly)

- Car Insurance: ~ $1,000 annual (~$83 monthly)

- Cost of Petrol: ~$300 monthly

- Cost of ERP: assuming average daily cost is $3, monthly estimate is $3 x 24 (including saturdays), monthly estimates $72

- Cost of Season Parking & Temporary Parking: $90 for season parking and $150 of office parking, $50 for temporary parking. monthly estimates $340.

The expense for this liability can cost you an average of $1,645 a month. Assuming you are drawing a monthly wages of $5,000, 33% is paid on a liability with has a depreciation value. Big Ouch for an average vehicle!

If you’ve read the fundamental of Power of Compounding, with $1,500 a month of investment, assuming you invest for 60 months similar term of financing a car, with an annual interest rate of 4.5%, you will in return receives $ 101,096 (your total investment base amount is $90,000 ), so you are making money here, does it still make sense to finace a car in Singapore?

Total Debt Servicing Ratio

Additionally, the Monetary Authority of Singapore (MAS) has introduce a Total Debt Servicing Ratio (TDSR) framework for all property loans granted by financial institutions (FIs) to individuals. The TDSR prohibits borrowers from taking or refinancing home loans that bring their total monthly debt repayments to over 60 per cent of their gross monthly incomes.

While this might be a good initiative by MAS to ensure borrowers from building up bad debts to an unaffordable level, it does affect genuine borrowers who are financially sound to leverage this as good debt, so do make prudent decision before taking up any loans as it will affect your purchase of your first property.

As a general guideline, it is recommended that your debt-to-service ratio should stand at around 35%. For example, if you are drawing a monthly income of $5,000, your debt/loan should not exceed $1,750. With only 65% remainder to play with you got only sufficient for saving / investment / protection and your daily necessities.