Overview

Personal Financial Literacy may sounds easy and everyone might thought they knew it. By scoring “A” in your mathematic subject in school or being an Accountant by profession may not mean that one has strong Financial Literacy. This is a knowledge or skill which is definitely not completely taught in school. So where did we learn Financial Literacy from and who taught us?

Does the following sounds familiar to you?

“Child, do not spend every single cents you have, save a portion of them.”

That is when we start to have our very first POSB Saving account at a very young age, walking out of the Bank with a Squirrel Bank to slot in our spare coins.

How about this:

“Child if you don’t study hard enough now and keep playing Pokemon Go, you will end up sweeping the floor in public in future to earn a living”.

I believe that’s pretty much all that we had learn in Financial Literacy, save money, don’t spend all our money, study hard so that we no need to sweep the floor in public. These are definitely great teaching, however, still far from what Financial Literacy is.

So what if we are not Financially Literate?

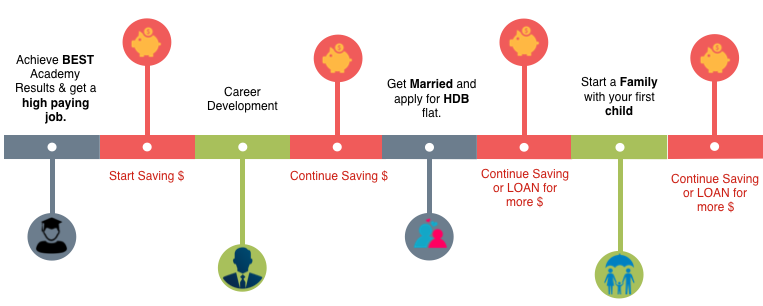

Financial Literacy is definitely important in our modern Singapore. Without these fundamentals we will be living in a typical life process, just like we’ve drawn into a “matrix” where our society has created for all of us a very systematic approach in life, such as the following:

To a certain extent most of us get drawn into loans and bad debts, i.e. instalment plans for wedding, mortgage loan, home renovation loan, car loan, credit card loan, just to make sure these stages of life are marked on our checklist at the your expectation, your parents or most probably your peers, since our culture tend to have us compete. “Before you make it you must show people you’ve made it”. In my opinion, I just felt that this shouldn’t be the default process we should lead and pursue in life. Being financially sound is not about how much loan a bank is willing to lend you, it’s how well you manage your finances. There is a significant difference between good debts and bad debts, but often in such a process process in life, most of us got ourselves into bad debts.

Based on this article from Strait Times, as of June 2015, total debtors (85,352) make up 5 per cent of the total population of unsecured credit customers (1,632,530). With a total amount of $288,445,498. A 32 per cent jump since 2011. I hope you are not one of them.

How ironic when you are working day in day out to repay loans just to go through these stages. So this is what most of us were taught or cultivated, following the common path. And when we are unable to save enough, we work harder to get/fight/demand a promotion for pay increment or wait for a pathetic 5% to 10% annual increment, probably lesser than 3% for most employees. Worst still, get loans from financial institutes.

Financial Literacy is more than what we were taught or what we’ve seen from our parents. Its being our own Chief Financial Officer (CFO) of your own life, managing and growing your wealth in a more effective and suitable way according to your very own appetite so that you will not be a slave to money forever.

We must learn how to leverage on money and to have them act as a tool to work hard for us, not us working hard for money forever. Would you prefer a typical life stages process where you have to work for money forever till you stepped into your grave or do you prefer to work hard for money at your earlier or active age in life and have your hard earned money work much harder for you so that you need not fight for daily survival forever? You have a choice if you can accept Delayed Gratifications, sacrifices unnecessary spendings and in years to come you will have your first pot of gold working hard for you.

Lastly, please do not put the burden of supporting your old age onto your next generation, whom are your children. That is cruelty! At the rate Singapore is changing and growing, our next generation will definitely have a much tougher in the future, so please lighten their load by effectively managing your finance and plan your finances early to achieve a self sustainable & comfortable (not only yourself but your children as well) retirement.

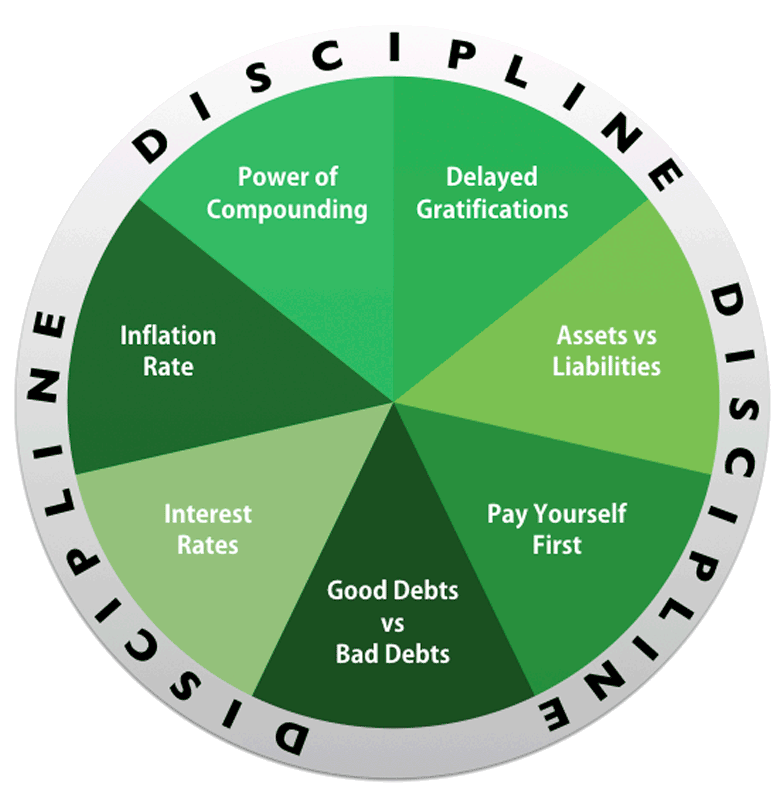

What does these 8 fundamentals of Financial Literacy do?

With the knowledge of Financial Literacy in Singapore context, you will tend to realise how our emotion works with money, what are the things that are worth your purchase (note that I’m not using the word spend here) and what are not. What are the things that will slow down and speed up your financial goals, etc.. with these fundamentals you will be able to effectively worked out your desired Financial Plan with the Financial Planning Pyramid that you should never sway away from IF you have inculcated the DISCIPLINE to abide to them.

Most Financial Planners often present the Financial Planning Pyramid and begin explaining to you the value of it. However, in my opinion, while it is important, we shouldn’t neglect the correct fundamental that encompass it. Without the fundamentals it will be a like a Pyramid of Giza made of soil… instead of Limestones. it will collapses in a matter of time.

So now, before we look at the Financial Planning Pyramid and understand it, you will definitely need to understand the 8 key Fundamentals of Financial Literacy. I highly recommend everyone to have a clear understanding of these fundamental, because these will make your financial plan more sensible and effective.

Most importantly, you will need strict DISCIPLINE in adopting and cultivating these fundamentals when applying in the Financial Planning Pyramid as a guideline in your planning. Above all, you will definitely cultivate greater money sense in your daily life. Its not about being stingy or thrifty but wiser in managing you money.

So what are the 8 key fundamentals?

Bear in mind that DISCIPLINE is the 1st and most important fundamental of all, without Discipline, nothing will work even if you understand the other 7.